Lending Institution: Your Entrance to Financial Health

Debt unions have become a vital conduit to financial stability, supplying a host of benefits that conventional banks might not provide. From customized focus to competitive prices, they cater to the individual requirements of their members, fostering a sense of neighborhood and count on that is often doing not have in larger banks. The question stays: how do credit scores unions achieve this special balance of individualized service and monetary advantages, and what sets them apart in the world of financial health?

Advantages of Signing Up With a Credit Rating Union

Moreover, by joining a cooperative credit union, people come to be part of a neighborhood that shares comparable economic goals and worths. This feeling of belonging fosters depend on and loyalty among members, creating a supportive setting for achieving economic success. In addition, cooperative credit union are recognized for their dedication to local communities, frequently reinvesting earnings into community advancement initiatives. By lining up with a cooperative credit union, people not only boost their very own financial wellness but additionally add to the financial development and success of their area.

Personalized Financial Solutions

When seeking tailored monetary services, members of lending institution can benefit from tailored guidance and solutions designed to satisfy their one-of-a-kind needs and objectives. Cooperative credit union prioritize recognizing their participants' financial scenarios, objectives, and constraints to use tailored solutions that traditional banks may not supply. This personalized method enables cooperative credit union participants to access an array of monetary services and products that cater specifically to their individual situations.

Credit report unions supply individualized economic remedies such as customized budgeting strategies, financial investment techniques, and finance alternatives tailored to participants' credit history and financial histories. By working closely with their participants, lending institution can provide guidance on how to boost credit rating, save for specific goals, or browse monetary difficulties. Furthermore, debt unions commonly give monetary education sources to encourage participants to make informed choices regarding their finance. On the whole, the individualized touch offered by lending institution can assist participants achieve their monetary objectives properly and successfully (Credit Union in Cheyenne Wyoming).

Lower Charges and Affordable Rates

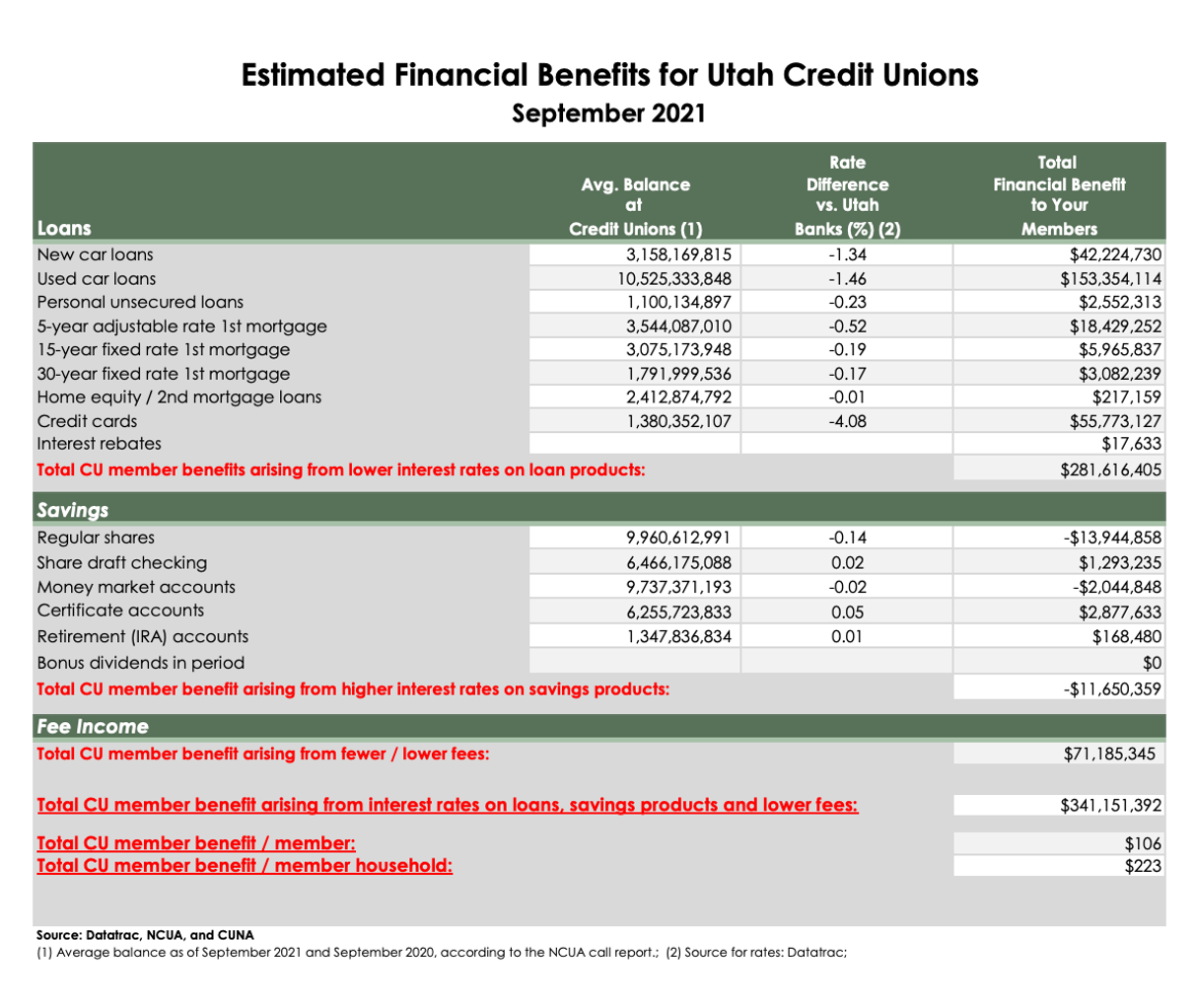

In the realm of economic solutions, lending institution set themselves apart by using participants reduced costs and affordable prices contrasted to standard banking establishments. One of the vital advantages of cooperative credit union is their not-for-profit structure, which allows them to focus on the monetary health of their participants over maximizing revenues. Therefore, credit scores unions can use reduced fees on solutions such as inspecting accounts, cost savings accounts, and finances. This cost framework can cause substantial cost financial savings for members in time, especially when contrasted to the charge timetables of lots of standard financial institutions.

In addition, credit report unions typically offer a lot more competitive rate of interest on interest-bearing accounts, certifications of deposit, and financings. By preserving reduced operating costs and focusing on serving their participants, debt unions can hand down the advantages in the form of higher interest rates on cost savings and reduced rates of interest on financings. This can help participants grow their financial savings much faster and pay less in rate of interest when obtaining money, eventually adding to their general financial well-being.

Neighborhood Focus and Customer Support

With a solid focus on area focus and remarkable customer care, cooperative credit union identify themselves Wyoming Credit Unions in the economic solutions market. Unlike standard financial institutions, cooperative credit union prioritize developing solid connections within the neighborhoods they serve. This community-centric method enables cooperative credit union to better comprehend the unique financial requirements of their participants and tailor their services appropriately.

Customer support is a top concern for lending institution, as they strive to provide individualized aid per participant. By providing a more human-centered technique to financial, lending institution create a welcoming and encouraging atmosphere for their members. Whether it's helping a member with a car loan application or offering economic guidance, cooperative credit union personnel are known for their alert and caring service.

Achieving Financial Goals

One way credit rating unions support members in achieving their economic goals is by using monetary education and learning click here now and sources. With workshops, seminars, and individually assessments, debt union personnel provide important insights on budgeting, saving, spending, and taking care of debt. By equipping participants with the needed understanding and skills, lending institution empower individuals to make informed financial choices that line up with their objectives.

Furthermore, lending institution supply a large range of financial items and services to assist members reach their details goals. Whether it's obtaining a mortgage, establishing up a retirement account, or beginning a college fund, debt unions give tailored options that satisfy participants' distinct requirements. By working closely with each member, cooperative credit union ensure that the financial product or services suggested remain in line with their long-term and short-term monetary objectives.

Verdict

Finally, lending institution provide a portal to economic well-being through customized focus, customized financial remedies, reduced fees, and competitive rates. As member-owned cooperatives, site they focus on the demands of their members and offer better rates of interest on interest-bearing accounts and lower lending prices - Credit Union in Cheyenne Wyoming. With a community focus and dedication to customer service, cooperative credit union make every effort to understand their members' distinct monetary circumstances and objectives, supplying tailored guidance and assistance to aid people attain their economic objectives

Additionally, credit score unions usually give economic education and learning and therapy to assist members improve their financial literacy and make far better choices regarding their cash management.

Credit history unions supply customized financial remedies such as customized budgeting strategies, financial investment approaches, and lending alternatives customized to members' credit history ratings and monetary backgrounds. Credit Union Cheyenne WY.One means credit score unions support members in accomplishing their financial objectives is by offering economic education and sources. By working carefully with each member, debt unions make certain that the financial items and solutions suggested are in line with their short-term and long-lasting financial goals

With an area focus and commitment to consumer solution, credit rating unions make every effort to comprehend their participants' special monetary scenarios and goals, providing individualized assistance and assistance to help individuals accomplish their economic purposes.